Previous Highs and Lows (Liquidity Pools)

So liquidity is what draws a price up and down. Liquidity is a magnet for a price. In a financial market, liquidity pools mean money.

We can find liquidity in the following places.

Above previous highs - Buy side Liquidity.

Below Preivouos Lows - Sell Side Liquidity.

Above equal Highs

Below Equal Lows

Identifying liquidity pools

It’s not much use identifying something after the fact; hindsight is 20/20, and monetizing isn’t easy.

Not to worry, identifying liquidity pools is very simple.

Look for the most obvious and aggressive place to stop – a recent swing high or low.

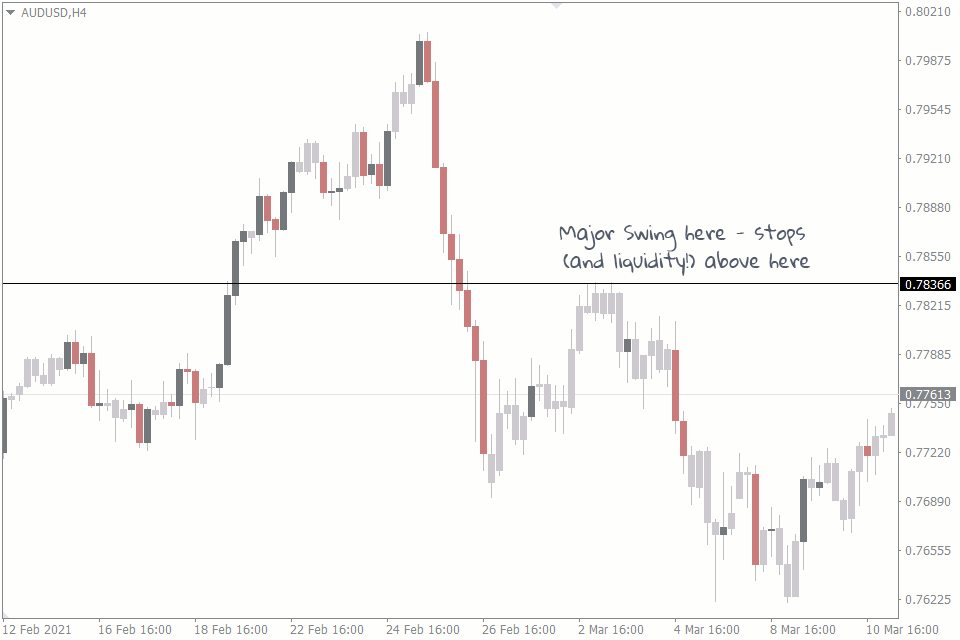

Let’s take a look at another example of AUDUSD, but this time on the short side:

This is a major swing level; we know people will be shorting against it with stops (and liquidity!) above.

Let’s see what happens:

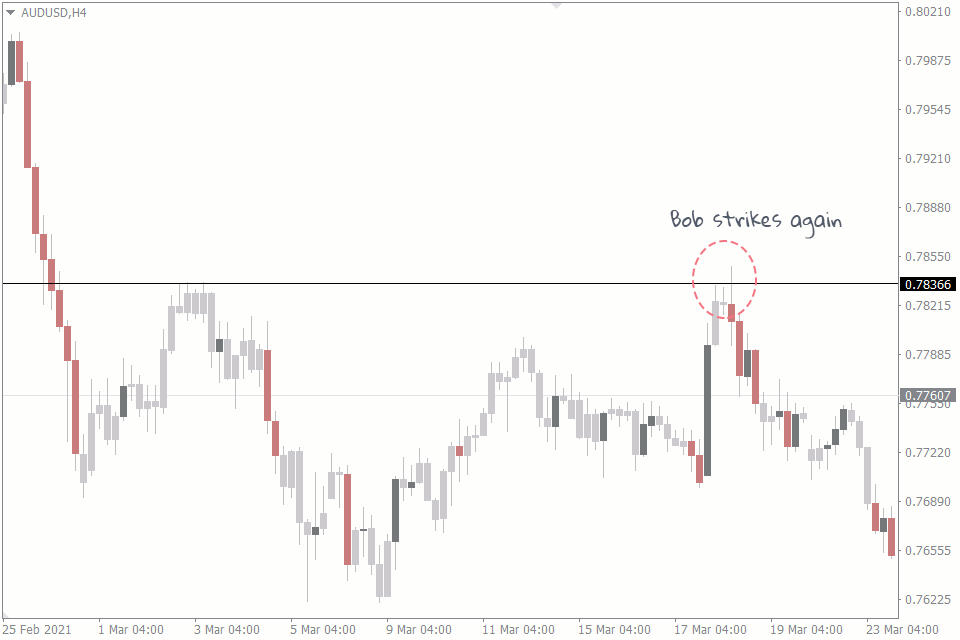

What do you know?

The level is breached, stop orders want to fill, and Smart Money is happy to fill them.

Identifying liquidity pools is as simple as finding glaringly obvious points of support and resistance where traders are likely to place their stops.

Liquidity is where dumb money keeps its Stop Losses.

Last updated