Meta Trader Order Types

Before you jump into the trading arena, there are some types of forex orders you must be familiar with and be able to use in your trading experience. In Forex, the term order refers to how you will instruct your broker to enter or exit a trade on your behalf. However, the days of calling your broker on the phone are over, and now… you need to do everything independently, including placing market orders in the forex market. That’s right, welcome to the modern world.

Forex Order Types

There are many different types of Forex orders, which traders use to manage and execute their trades. While these may vary between different brokers, there are some basic order types that all brokers accept.

These orders fall into two categories:

Market order: an order immediately executed for a price that your broker provides at that given moment. These include buy and stop orders.

Pending order: an order to be executed later at the specified price. These include buy limit and sell limit orders, buy stop, and sell stop.

What is a Market Order?

A market order is an order to buy or sell at the current price and is the simplest order to get instant market execution. For example, the bid price for the currency pair EUR/USD is currently at 1.1920, and the asking price is at 1.1922. If you wanted to buy EUR/USD at market price, then it would be sold to you at a price of 1.1922.

Technically, you would click buy on your trading platform, and your trading platform would instantly execute a buy order at that (hopefully) exact price. It is important to note that depending on Forex market conditions, there may be a difference between the price you selected and the final price executed on your trading platform. This is known as slippage.

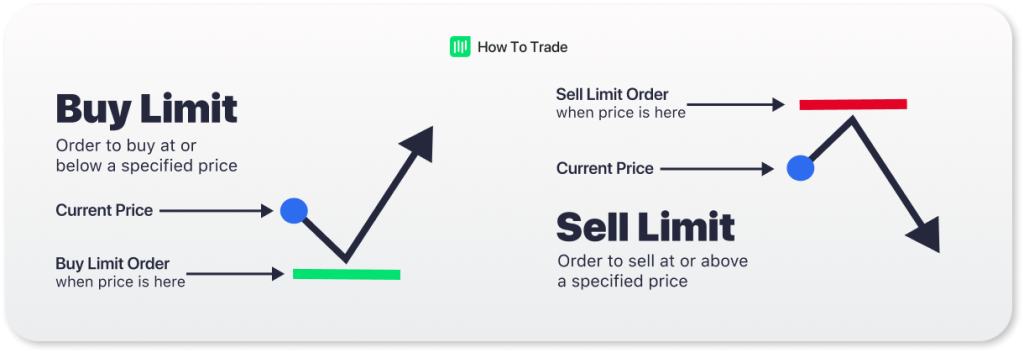

What is a Limit Order?

A limit order is an order to buy or sell if the market moves to your desired level at a specified limit price. Think of a limit price as a price guarantee. By setting a limit order, you are guaranteed that your order only gets executed at your limit price (or better).

You can place a “Buy Limit” order at or below a specified price.

You can place a “Sell Limit” order to sell at a specified price or better.

Once the market reaches the limit price, the order is triggered and executed at the limit price (or better). Limit orders work for you and can only be executed once the price becomes more favorable. The catch is that the market price may never reach your limit price, so your order may never get executed.

An Example of a Buy Limit Order

Look at the image below. The blue dot symbolizes the current market price. The green line symbolizes your buy limit market order price.

For example, the EUR/USD is trading at 1.1950 (blue dot). But you want to go long and the EUR versus the US dollar if the market moves downward and the price reaches 1.1900 (red line).

This is where you’d set a buy limit order at 1.1900.

If the market price drops to 1.1900 or exceeds your chosen ‘Buy Limit Order’ price, your order will be automatically triggered. Essentially, you are trying to buy the asset at a cheaper price as you believe the 1.1900 is a crucial support level.

IMPORTANT: A limit order to BUY at a price below the current market price will be executed at a price equal to or less than the specified stop price.

An Example of a Sell Limit Order

Once again, look at the image above on the sell limit illustration. The blue dot symbolizes the current price. The red line symbolizes your sell limit order price. For example, EUR/USD trades at 1.1920 (blue dot). If the price reaches 1.1950 (red line), you want to go short.

This is where you’d set a sell market order at 1.1950.

If the price goes to 1.1950, your trading platform will automatically execute a sell order at the best available price.

IMPORTANT: A limit order to SELL at a price above the current market price will be executed at a price equal to or more than the specific price.

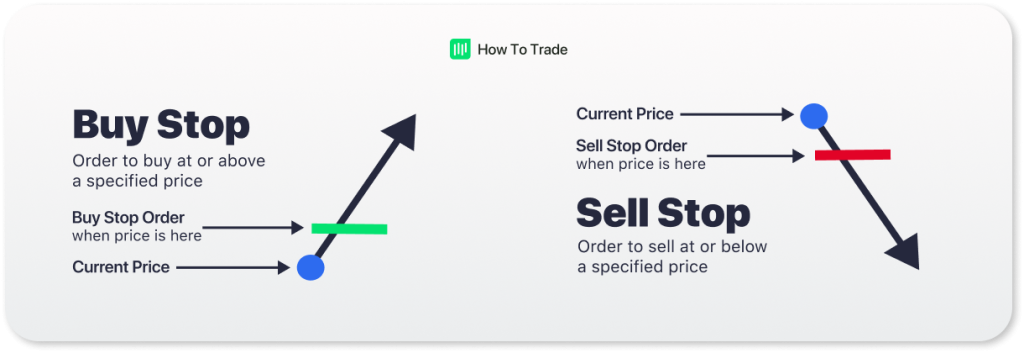

Stop Entry Order

A stop entry order “stops” an order from being executed until the price reaches a stop price. This type of order is used in a trading strategy when you want to buy only after the price rises to the stop price or sell only after the price falls to the stop price.

A stop order can only be executed when the price becomes less favorable. However, it becomes a market order when the trend starts, and you see the new price as the best limit entry order to join the trend.

Stop Loss Order

This type of order is slightly different from the order types above. This is simply because the types above are orders to get you into a trade, meaning these orders are entry pending orders. A stop-loss order is a limit order to get you out of the trade. It’s an exit order.

This type of limit order serves the purpose of preventing additional losses if the price goes against you. So, if you are in a long position, it is a sell-STOP order. And if you are in a short position, it is a buy-STOP order.

For example, you went long (buy) EUR/USD at 1.1950. To limit your maximum loss, you set a stop-loss order at 1.1920. If you were dead wrong (unbelievable, I know) and EUR/USD dropped to 1.1920 instead of moving up; your trading platform would automatically execute a sell-stop order at 1.1920 or the best available price and close out your position for a 30-pip loss.

Remember, losing is a part of Forex trading, and a small loss is better than a big loss! Use stop-loss orders when trading the forex markets to mitigate your losses. Take them on the chin and move on.

Key Takeaways

The bottom line is that you need to know the different types of forex orders and implement them in your forex trading strategy. As you can tell, stop losses are extremely useful in Forex trading, especially if you don’t want to sit in front of your monitor, biting your nails all worried you will lose your money. At some point, you’ll use stop-loss orders when market news is released to reduce the risk of remaining open in the market and being exposed to unpredictable events.

Moreover, you can use other more ‘sophisticated’ forex limits and stop orders in the next levels. These include the trailing stop order, for example, and the take profit order. Whether you use fundamental or technical analysis (or both), it is a must-have knowledge to trade the forex markets.

That’s a lot of terms we covered today! Good job on reading down here. With this attitude, you’ll be trading like a pro soon! And don’t worry if things seem complicated; it gets easier with practice! Within a couple of weeks, you will set your limit orders on your trading platform with one eye closed! In the meantime, feel free to download the cheat sheet below to help you along the road.

Last updated